Hey guys, so as promised I am here with the results from my “No Spend April” challenge and I am soooooooo excited to share my results with you! First and foremost, this was not as hard as anticipated. Yes, it sucked, but we are reaping the rewards of being frugal! I have always wondered how people do it and make the “sacrifices” by cutting back and saying no to certain invitations and just focusing on the goal ahead. To be very honest, my husband and myself are terrible at money management. I always told myself I would be being better and had every intention, but we often just fell into a debt pit, overspent, and lived way beyond our means. I am so incredibly over that way of living. I seriously encourage EVERYONE to try these ‘no spend months’ and look at your bank account 30 days later and love what you just did. Pretty sure your bank account will love and thank you too lol.

Ok, so without further ado, here are our results….

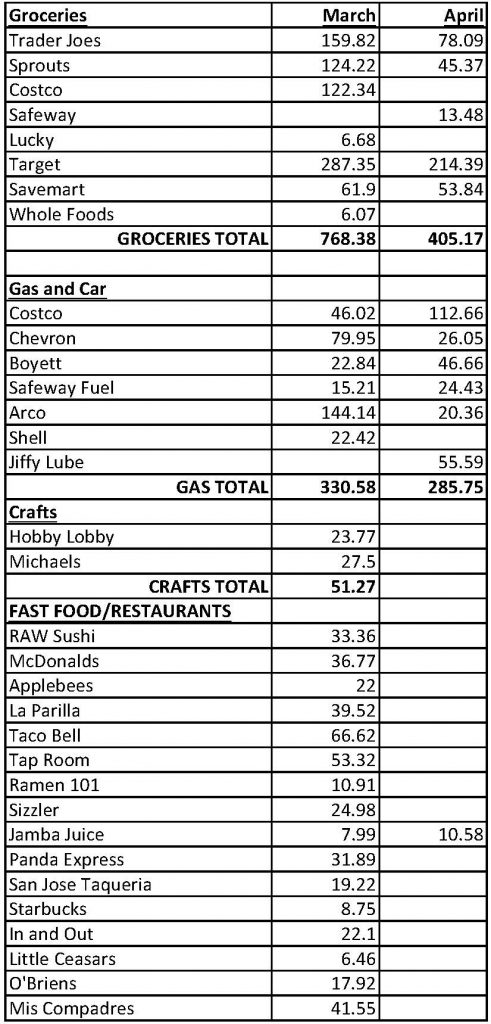

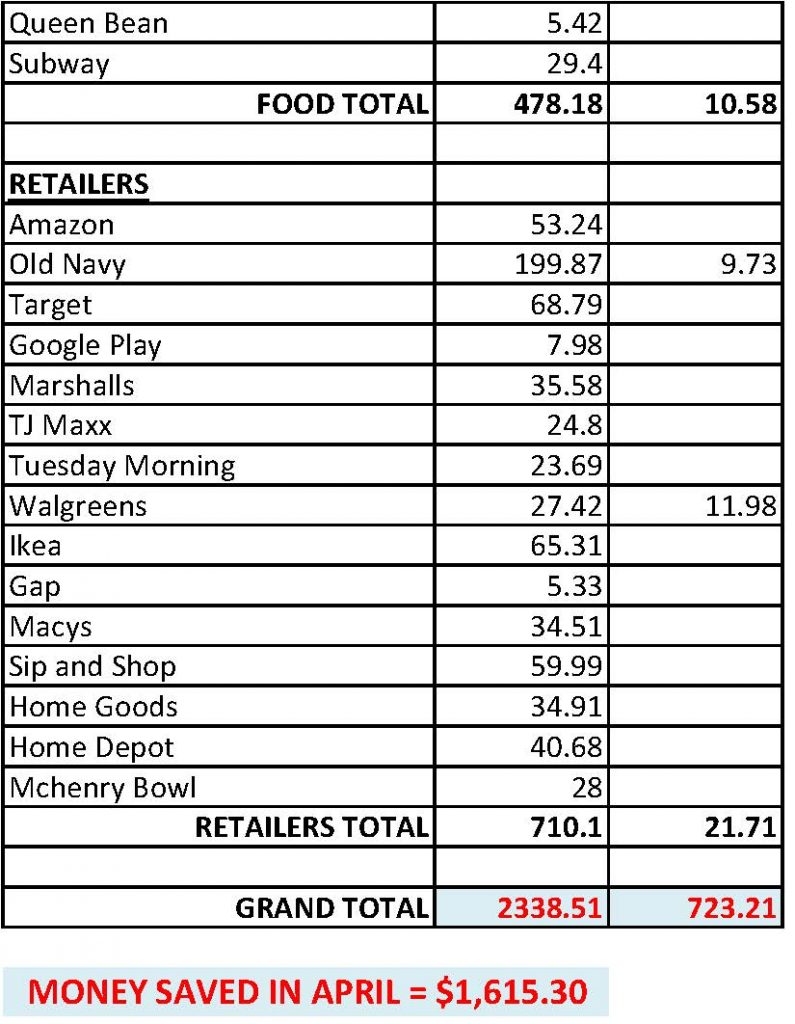

OUR MARCH VS. APRIL SPENDING

Ok, so as you can see we saved $1,615.30 in APRIL just by cutting out fast food, frivolous purchases, and being more conscious at the grocery store!!! I am amazed by this number and I am really proud of it too.

This side by side comparison opened my eyes to a lot of realizations. We were WAY overspending at the grocery store. I literally did not in any way neglect any department of the grocery store, I just planned better! I made enough dinner to have lunches the next day for us and it saved us so much money.

Our gas totals did not shock me one bit. I have always budgeted our gas to roughly be $320 a month.

My hobby lobby and michaels trips truly were adding up and very unnecessarily dwindling my bank account. I love buying stuff for our home, the kids to do crafts, or stuff for my happy planner but I don’t need any of it. I could honestly use the stuff I have at home and be perfectly content.

Our fast food and restaurant spending was out of control. Nearly $500 of our money was going to eating out… I am just not okay with that. It almost made me feel like, “well then why do I even grocery shop?” I just feel like cutting that out or only spending $20 a week each would be reasonable. Ideally zero would be great, but I know sometimes there will be instances where it’s not practical.

Oh boy, our retail shopping, I mean MY retail shopping, was so silly. I feel sick when I see that number. I was buying stuff because it was new, on sale, or just because I wanted new stuff haha. I had no real reason for it. That is changing big time.

I didn’t include our monthly bills like household payments, car payments, or our credit cards because those are not changing. However, I did just set us up with a credit card payment schedule and I am VERY excited to start that and reap those benefits.

I hope this post encouraged you to try this at least once to see how rewarding it truly can be!

xoxo, Jasmine

No Comments